Disclaimer: These tips are informational in purpose and should not be construed as legal advice. Please contact your own legal counsel prior to making any employment-related decisions.

With all the politics, state interpretations, and other changes in forms and processes, it’s getting harder and harder to comply with Form I-9 and employment eligibility requirements. In this guide, we’ll help you find your way to keep your business on the right side of the ever-changing laws.

- What is the difference between Employment Eligibility, E-Verify and Form I-9?

- What does E-Verify check for?

- What must I do to maintain I-9 Compliance?

- Who must comply with E-Verify?

- How do you check Employment Eligibility Status?

- How long do you have to complete and verify documents for I-9 compliance?

- How do I retain and store my Forms I-9?

- What Rights do Employees Have as it relates to Form I-9 and E-Verify?

- What Are Employer Penalties for Employment Eligibility Violations?

- What are my electronic Form I-9 Options?

- And NOW!

- Where do I find more information or resources about Form I-9 and E-Verify compliance?

What is the difference between Employment Eligibility, E-Verify and Form I-9?

Great questions! It’s easy to get these confused, when they’re really all part of the same thing.

Employment Eligibility Verification is the Department of Homeland Security (DHS) description for assuring that an employer only hires those individuals with the right to work in the United States. Keep in mind, the right to work is not dependent, per se, on an individual’s citizenship, immigration status, or ethnicity. Employees may be eligible if they have documentation proving their right to work, which is where Form I-9 comes in.

Form I-9 is the primary document filed with DHS to prove that your employee is eligible. It incorporates both a component of identity validation, and right to work validation. It is similar to filling out a tax form, in some ways. It requires you to physically see and copy the supporting documents (chosen from a list) for the employee’s verification of eligibility.

E-Verify is an electronic way of using those provided documents to instantly verify that an employee is indeed eligible to work in the US. You may or may not be required to use E-Verify, depending on if you have Federal contracts or subcontracts that contain the Federal Acquisition Regulation (FAR) E-Verify clause. That said, the government encourages use of E-Verify, so you know that you’re hiring a legal worker. It’s good to get going, because as of February 2018 a budget proposal from the President suggests it may be required as of October 2018. While that proposal doesn’t seem to be gaining traction now, that could change at any time.

While E-Verify is not mandated, if you do choose to use E-Verify, there are requirements you must follow. For example:

- Employers must post the E-Verify “Notice of Participation” and the Department of Justice “Right to Work” posters in English and Spanish

- Employers must use E-Verify only after the employee has accepted an offer of employment and completed Form I-9

What does E-Verify check for?

The purpose of E-Verify is to confirm the validity of the identity and right-to-work documents by matching the data provided with databases managed by the Social Security Administration (SSA) and Department of Homeland Security (DHS).

What E-Verify returns, is very simple statuses. E-Verify does NOT provide the employer citizenship status, immigration status, or anything else. It returns basically two choices:

Employment Authorized

No further action is required on your part. The names and numbers matched available records, and the employee is good to go.

DHS or SSA Tentative Nonconfirmation (TNC)

Tentative Nonconfirmation is exactly that. It just means that the names and numbers did NOT match existing records. This is NOT proof that the employee is not eligible to work. The employee has the right to contest this outcome, but first, you should double check your entries. indeed the vast majority of the time this occurs is due to data entry errors when submitting the form.

To help with this, DHS has established a compliance division, with officers reviewing data and searching for patterns of likely errors so they can contact the employer to prevent future errors. According to the DHS “USCIS protects E-Verify against system misuse through monitoring and compliance activities, such as identifying and resolving compliance issues, notifying employers of noncompliant behaviors, and offering compliance assistance in the form of emails, phone calls, desk reviews, and site visits. These monitoring and compliance activities assist and encourage E-Verify participants to use E-Verify as required by laws, rules, regulations and agency policies applicable to E-Verify and Form I-9, Employment Eligibility Verification.”

What E-Verify does NOT check for is immigration status, or citizenship. It basically simply gives a “yes” or a “maybe,” so be sure to follow the TNC guidelines below if you receive that status back. This is important to remain in compliance with Act 274B, which prohibits discrimination based on citizenship or immigration status.

How do I sign up for E-Verify

Signing up to participate in E-Verify is (surprise!) a somewhat complicated government process. On the USCIS’s checklist, the heading literally says “Enrolling in E-Verify is easy”, followed by a checklist of 22 items.

That said, the process consists of four steps.

- Fill out the forms online, which include questions about your company, your users, locations, and how you will access E-Verify.

- Electronic signature of the “Memorandum of Understanding” (commonly called the MOU, it’s the terms and conditions)

- Wait for verification from USCIS

- Have a user login, finalize password, and take the tutorial and knowledge test.

You can sign up for E-Verify here.

What must I do to maintain I-9 Compliance?

Maintaining I-9 compliance is comprised of four main components:

1. Know if you must comply, and if you’re required to use E-Verify. Your employment legal counsel can advise you on these matters. Don’t rely on articles on the internet (like this one!) for this very important information. Regulations vary based on your customers (Federal, State, Local government contracts for example) and other state and local requirements. The total number of employees may also make a difference.

2. Complete the Form I-9 correctly. This is the most common compliance mistake. Errors in completing documents can result in fines and penalties and you definitely want to avoid that. Common errors include using an old version of Form I-9, missing information (eg middle name), writing the wrong validated documents in the wrong fields, forgetting to complete a translator or preparer certification, and lots more. Here’s a more complete list of common errors. One of the primary ways to avoid these errors is to use an electronic I-9 solution which validates the form fields along the way, preventing pain later.

3. Complete the documents Sections ON TIME. Section 1 must be complete by the employee’s first day of work by filling out the Section completely and signing and dating. Keep in mind that SSN is NOT required if you’re not using E-Verify, and you cannot ask to see a document with an SSN on it to avoid violating Act 274B.

- Section 2 must be completed within three business days of the start of paid work. The employee must present to an authorized agent of your business (physically present) an original document or documents that show their identity and employment authorization, and your authorized agent (usually an employee) must certify they’ve reviewed the documents, and sign and date.

- Section 3 is less common and relates to employees employment authorization or more commonly, employment authorization documentation expires, you must re-verify their employment authorization no later than the date employment authorization expires.

4. Maintain your Form I-9 records for the appropriate duration. Forms must be kept for the longer of three years after the date of hire, or one year after the date the person leaves employment.

5. Audit, Audit, Audit. Don’t wait until USCIS comes knocking on your door. Conduct random audits of Form I-9 to ensure forms are completed accurately, on time, and that you have the appropriate document copies still available.

Sound complicated if you have a lot of employees? It can be. That’s one of the reasons to consider an electronic I-9 solution.

Who must comply with E-Verify?

For the most part, E-Verify is a voluntary program. Employers with certain government contracts or sub-contracts with what’s called the contain the Federal Acquisition Regulation (FAR) E-Verify clause is the primary exception, but some states also require some or all employers to participate. Similar to the FAR clause, these are primarily for State government contracts, but there are exceptions.

You should contact your employment legal counsel to find out for sure if you are required to use E-Verify.

If you are NOT required to use E-Verify, you may still choose to enroll and use it. The benefits to you as an employer are to be confident that you are complying with Federal Act 274A, which prevents the hiring of known Unauthorized Aliens.

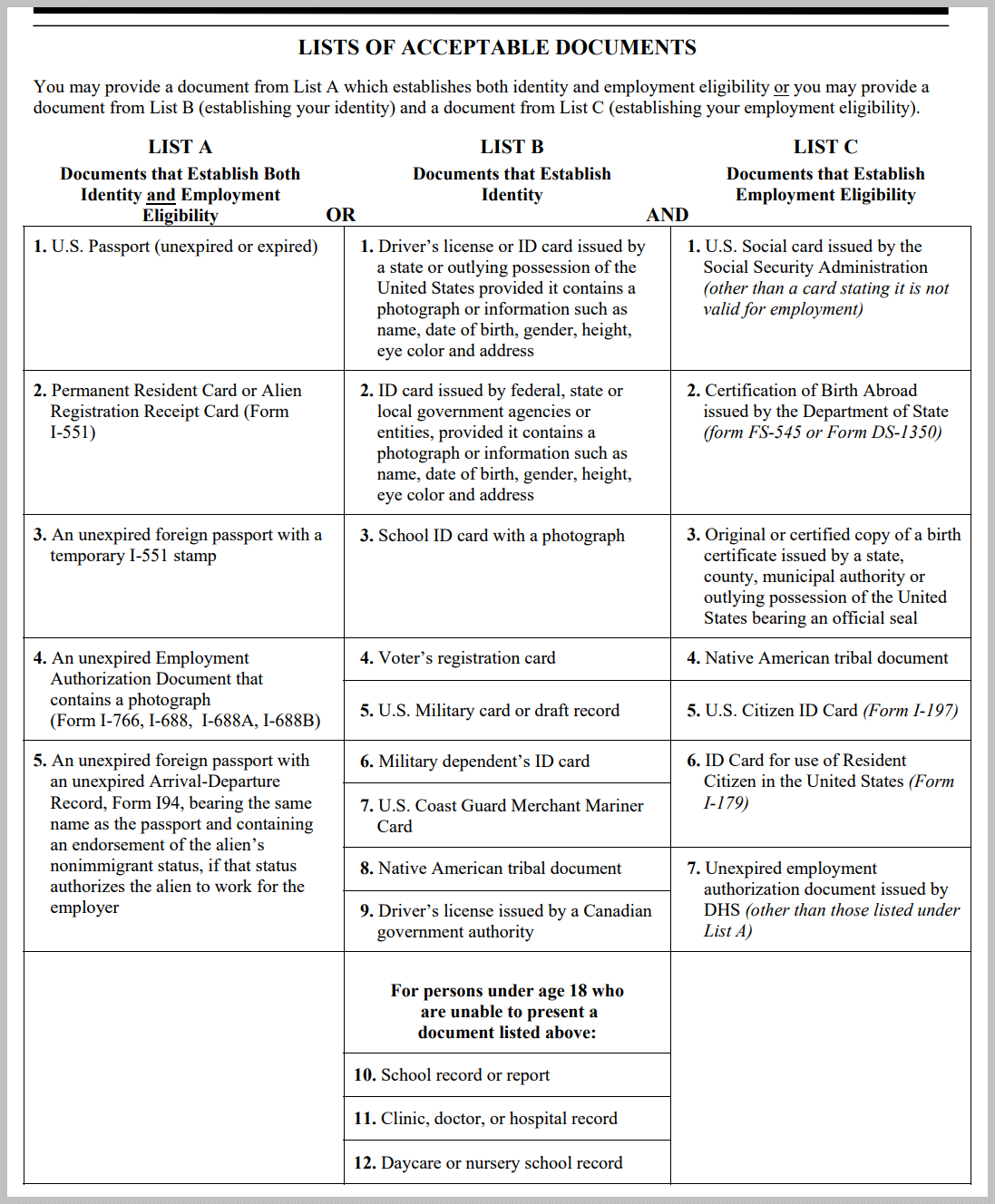

What are acceptable documents for Form I-9?

The documents employees must provide generally depend on what they have in order to demonstrate identity and right to work status. Some documents demonstrate one or the other, so the employee may have to provide more than one document. See below for the table of acceptable documents.

How do you check Employment Eligibility Status?

Maintaining I-9 compliance is comprised of four main components:

1. Know if you must comply, and if you’re required to use E-Verify. Your employment legal counsel can advise you on these matters. Don’t rely on articles on the internet (like this one!) for this very important information. Regulations vary based on your customers (Federal, State, Local government contracts for example) and other state and local requirements. The total number of employees may also make a difference.

2. Complete the Form I-9 correctly. This is the most common compliance mistake. Errors in completing documents can result in fines and penalties and you definitely want to avoid that. Common errors include using an old version of Form I-9, missing information (eg middle name), writing the wrong validated documents in the wrong fields, forgetting to complete a translator or preparer certification, and lots more. Here’s a more complete list of common errors. One of the primary ways to avoid these errors is to use an electronic I-9 solution which validates the form fields along the way, preventing pain later.

How long do you have to complete and verify documents for I-9 compliance?

The employee must complete Section 1 on or before the first day of paid work. This can be done with the onboarding process ahead of time, or most commonly in the morning of the first day along with other paperwork.

The employer has up until the third business day after the start of paid work to review the original documents provided by the employee. If the employee is going to be hired for less than three days, the documents must be presented and verified within one business day.

Download The Ultimate Guide to I-9 Compliance as a pdf

How do I retain and store my Forms I-9?

You must retain the Forms I-9 and the supporting documents for three years after the date of hire, or one year after the date of termination (regardless of cause), whichever is longer. So, if an employee only works for one month, you must retain the Form I-9 and the documents thirteen months total.

What Rights do Employees Have as it relates to Form I-9 and E-Verify?

- Employees have the right to know if you participate in E-Verify. Employers must post the E-Verify “Notice of Participation” and the Department of Justice “Right to Work” posters in English and Spanish.

- Employees must be able to know they’ve received a Tentative Nonconfirmation (TNC) and have the ability to contest it.. Your must give the employee a Further Action Notice in English and a translated version, if appropriate, with information on how to contest the TNC. That notice will indicate whether the U.S. Department of Homeland Security (DHS) or the Social Security Administration (SSA) issued the TNC. This notice is generated from E-Verify.

- The employee must be provided the information of HOW to contest a TNC, including the timelines/deadlines to do so. If an employee wishes to contest the TNC, you must provide a Referral Date Confirmation with the deadline and process to visit SSA or call DHS.

- You must allow the employee to start and continue working during the E-Verify process, including during the process of contesting a TNC.

- The employee must be able to present to you the documents of their choice, as long as they meet the requirements of List A or List B and C. It’s not up to your convenience, and you cannot request that they present certain documents.

What Are Employer Penalties for Employment Eligibility Violations?

Generally speaking, if an employer is audited and discrepancies are found, the inspecting officers present the employer with ten days to remediate the issues. Most of the time, if the employer has been following best practices, correcting these issues such as presenting a Form I-9 for an employee is pretty easy.

Things change though if an employee repeatedly or knowingly violates the rules. According to ICE, “Monetary penalties for knowingly hire and continuing to employ violations range from $375 to $16,000 per violation, with repeat offenders receiving penalties, at the higher end. Penalties for substantive violations, which includes failing to produce a Form I-9, range from $110 to $1,100 per violation. In determining penalty amounts, ICE considers five factors: the size of the business, good faith effort to comply, seriousness of violation, whether the violation involved unauthorized workers, and history of previous violations.” Suffice to say, these penalties can really add up, so maintaining Form I-9 compliance is really important to your business!

What are my electronic Form I-9 Options?

Using an electronic Form I-9 solution with E-Verify can simplify compliance in a number of ways.

- Ease the E-Verify registration process. Your solution partner will probably do this for you, and you’ll just electronically sign the MOU.

- Prevent form completion errors. With automatic validation of the data you put in fields, the most common mistakes such as making a typo mistake, or using the wrong document number in the wrong place are completely eliminated.

- Automatically send to E-Verify. One the Form I-9 is completed, the correct data can be sent to E-Verify and returned with the response.

- Automated TNC letters and notifications. This is a biggie of course. Not complying with the TNC process is one of the biggest risks about E-Verify facing employers.

- Storing documents for the correct amount of time, and correctly disposing them when the time is complete.

- Reminders for re-verification of documents at the time of document expiration.

- ICE audit support. Electronic systems make it easier to find the documents and supporting images you need when you are audited.

And Now!

Hopefully you are now well on your way to I-9 Compliance. Please contact our friendly team to learn more about how Pre-Employ’s Electronic I-9 can help you maintain compliance with much less hassle. THANK YOU!

Where do I find more information or resources about Form I-9 and E-Verify compliance?

Always start with your employment legal counsel, but USCIS and DHS have provided a lot of documentation to try to make it easier for employers to maintain I-9 compliance.

Are you sure You’re compliant with i-9 requirements?

Let us help clear any confusion!

Download Form

With all the changes in immigration policy, special programs, and policies, knowing the correct processes for maintaining I-9 compliance may seem complicated. With this guide, you’ll have the most common questions regarding I-9 and E-verify answered all in one place!

Oops! We could not locate your form.